PRP

The Icon PRP is an easy, affordable way for businesses to offer a retirement plan

- API

What is a PRP?

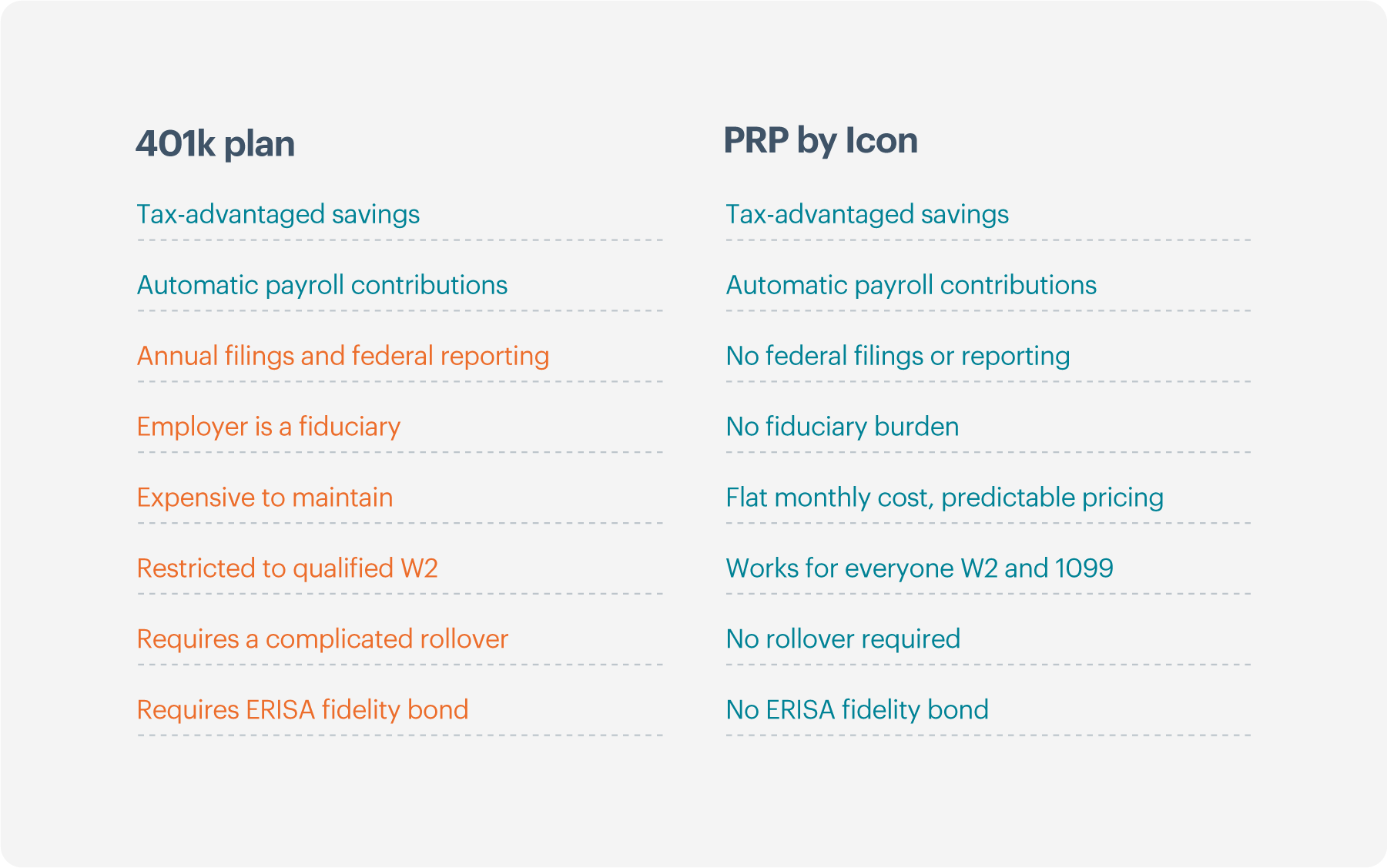

Portable Retirement Plans (PRPs) by Icon are a new type of retirement benefit that removes the cost, complexity, federal filing requirements, and fiduciary responsibility from employers. It delivers retirement savings and investing tailored to the needs of the individual saver. PRPs use a payroll IRA, removing the need for rollover at job change—saving time and money for businesses and employees.

How is a PRP different?

PRPs are a modern and seamless alternative to traditional 401k plans, delivering an easy and cost-effective way for businesses of all sizes to provide a high-quality retirement plan.

What are the benefits of a PRP?

Icon PRPs are fully integrated, delivering a comprehensive plan that’s both high-quality and affordable.

- Effortless Administration - Plans can be set up in minutes, eliminating the need for plan documents, lawyers, or headaches. Icon handles administrative tasks, including processing contributions, plan enrollment, customer support, and compliance.

- Simplified Compliance - PRPs remove the need for compliance testing, audits, and federal filings, freeing you from fiduciary responsibility.

- Streamlined Integration - Icon plans seamlessly integrate with isolved Payroll for easy syncing of employee data and automated retirement deductions.

- Impressively Affordable - These all-digital plans deliver a simplified retirement option at a lower cost. Employers pay a flat fee based on the number of employees, and enrollment is unlimited.

- Accessible to All Employers -Icon plans are suitable for employers of any size and qualify for state retirement mandates, offering a versatile retirement option for a diverse range of businesses.

How does the app work?

Icon’s integration with isolved means employers have no manual work to run their PRP. The integration automatically invites new employees and manages their contributions each time you run payroll.

If you are an employer currently using this app and have questions about the integration, please contact your isolved Customer Service Representative.

If you are an employer interested in learning more about this app, please use the Contact Us button above to be connected.

- Benefits

- Financial

- Retirement