isolved WOTC

Provided by isolved

See if your organization qualifies for employment tax credits

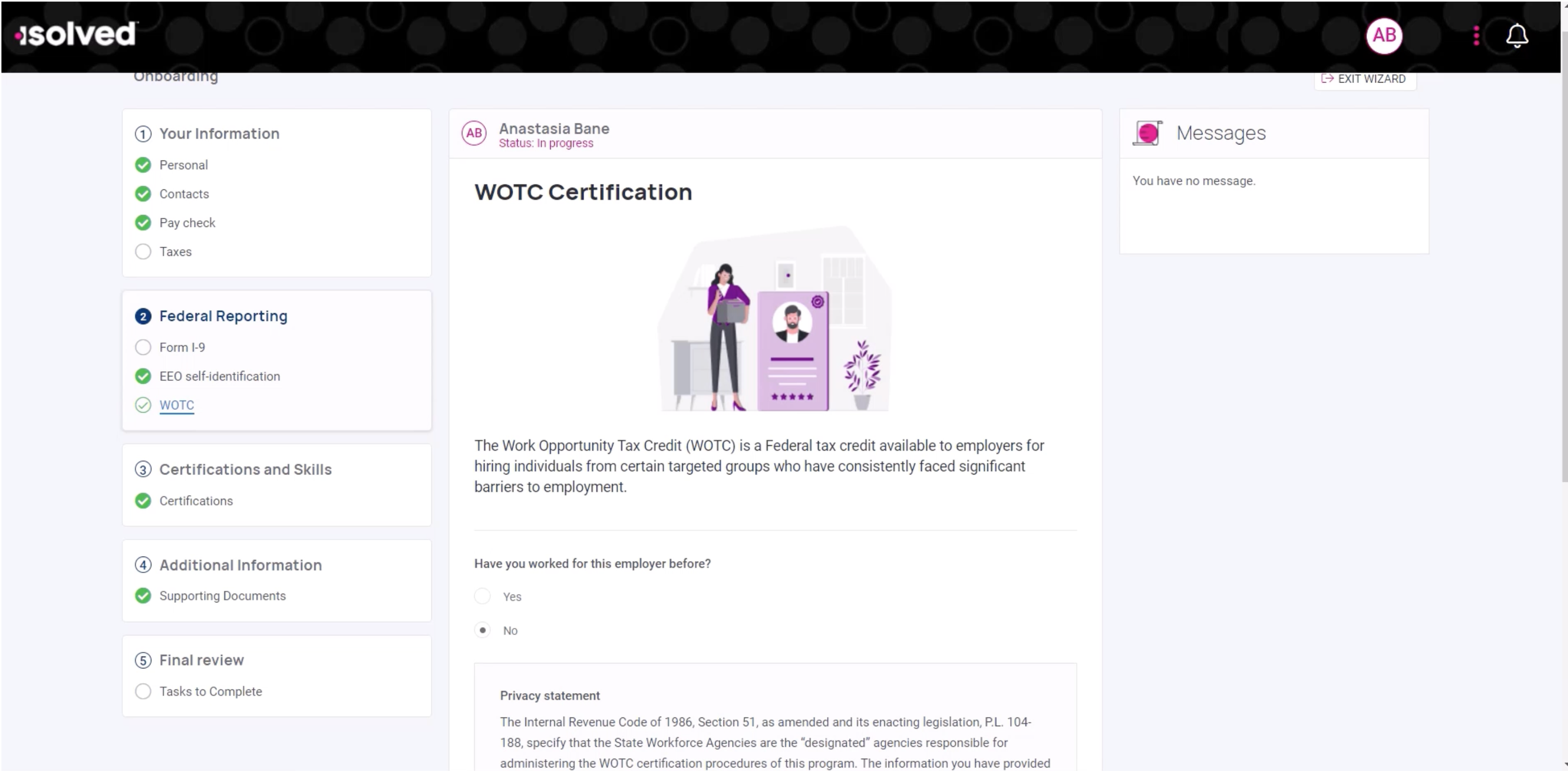

What is WOTC Management?

isolved partners with you to streamline the Work Opportunity Tax Credit (WOTC), a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment.

What are the benefits of using WOTC Management?

By hiring an individual who is in a WOTC targeted group, your organization may qualify to claim a tax credit. Whether it’s answering your questions, untangling “government speak”, researching new incentives on federal and state levels, or simply talking to you about these tax credit programs, the isolved tax credit department is ready to help you. Topics cover many categories including:

Disabled or unemployed veteran

Vocational rehabilitation referral

Summer youth

Ex-offender

Supplemental Security Income (SSI) recipient

Food stamp recipient

Designated community resident

Long-term unemployed

Temporary Assistance for needy Families (TANF)

And more

If you are an employer currently using this app and have questions about the integration, please contact your isolved Customer Service Representative.

If you are an employer interested in learning more about this app, please use the Contact Us button above to be connected.

Availability varies based on your organization’s configuration. Please reach out to your sales representative to confirm.